The Evidence

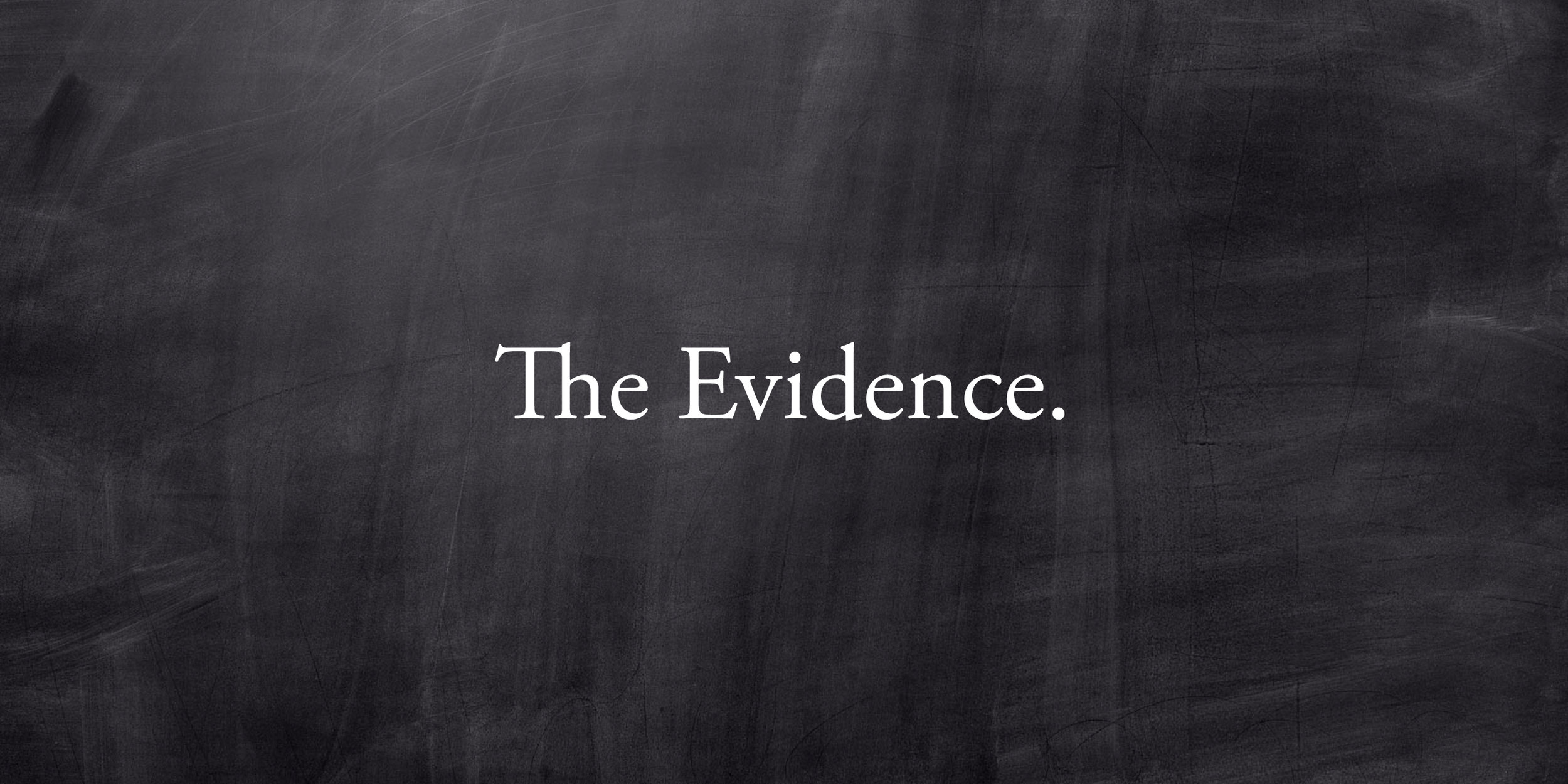

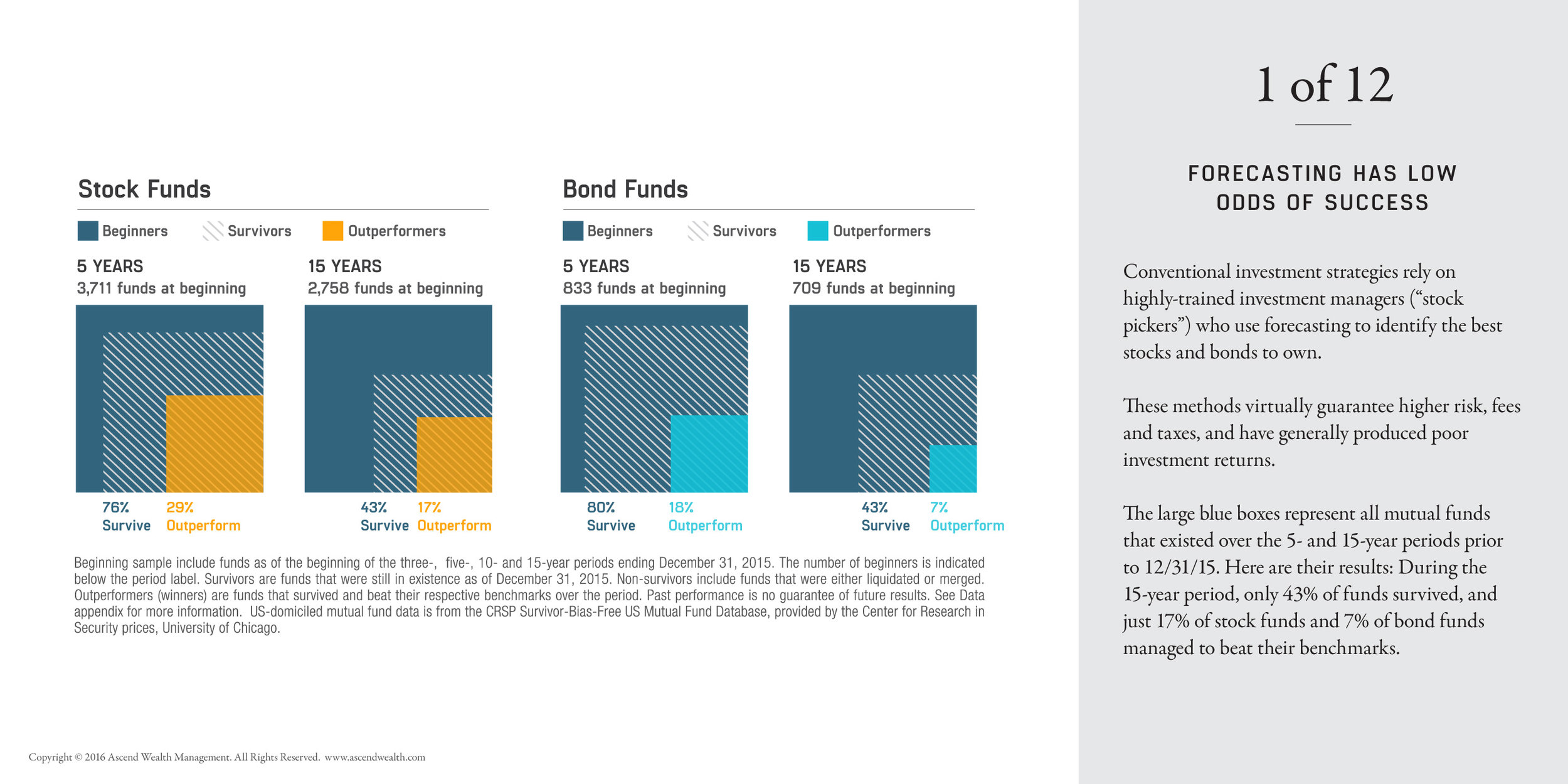

Forecasting Has Low Odds of Success

Conventional investment strategies rely on highly-trained investment managers (“stock pickers”) who use forecasting to identify the best stocks and bonds to own.

These methods virtually guarantee higher risk, fees and taxes, and have generally produced poor investment returns.

The large blue boxes represent all mutual funds that existed over the 5- and 15-year periods prior to 12/31/15. Here are their results: During the 15-year period, only 43% of funds survived, and just 17% of stock funds and 7% of bond funds managed to beat their benchmarks.

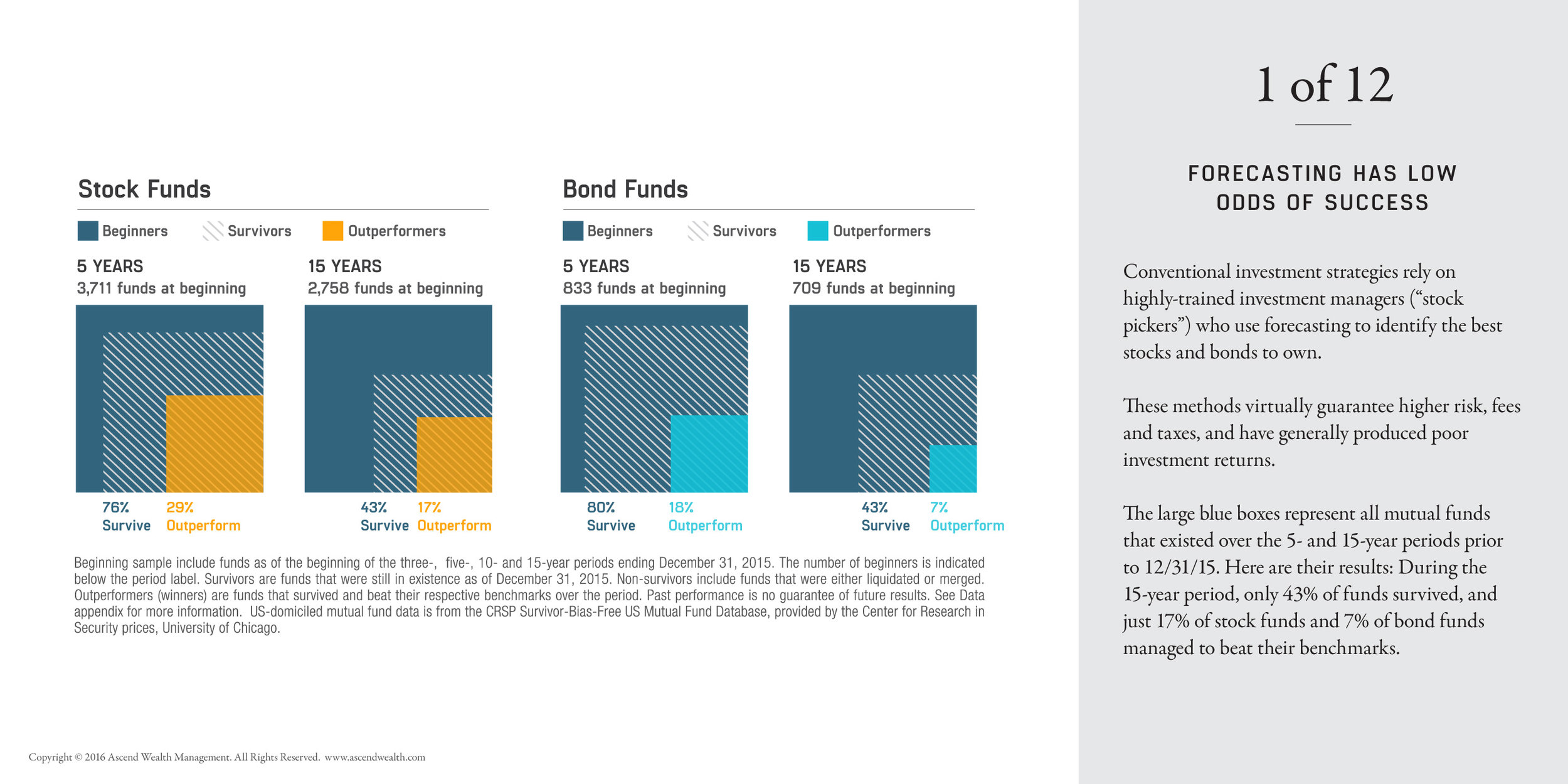

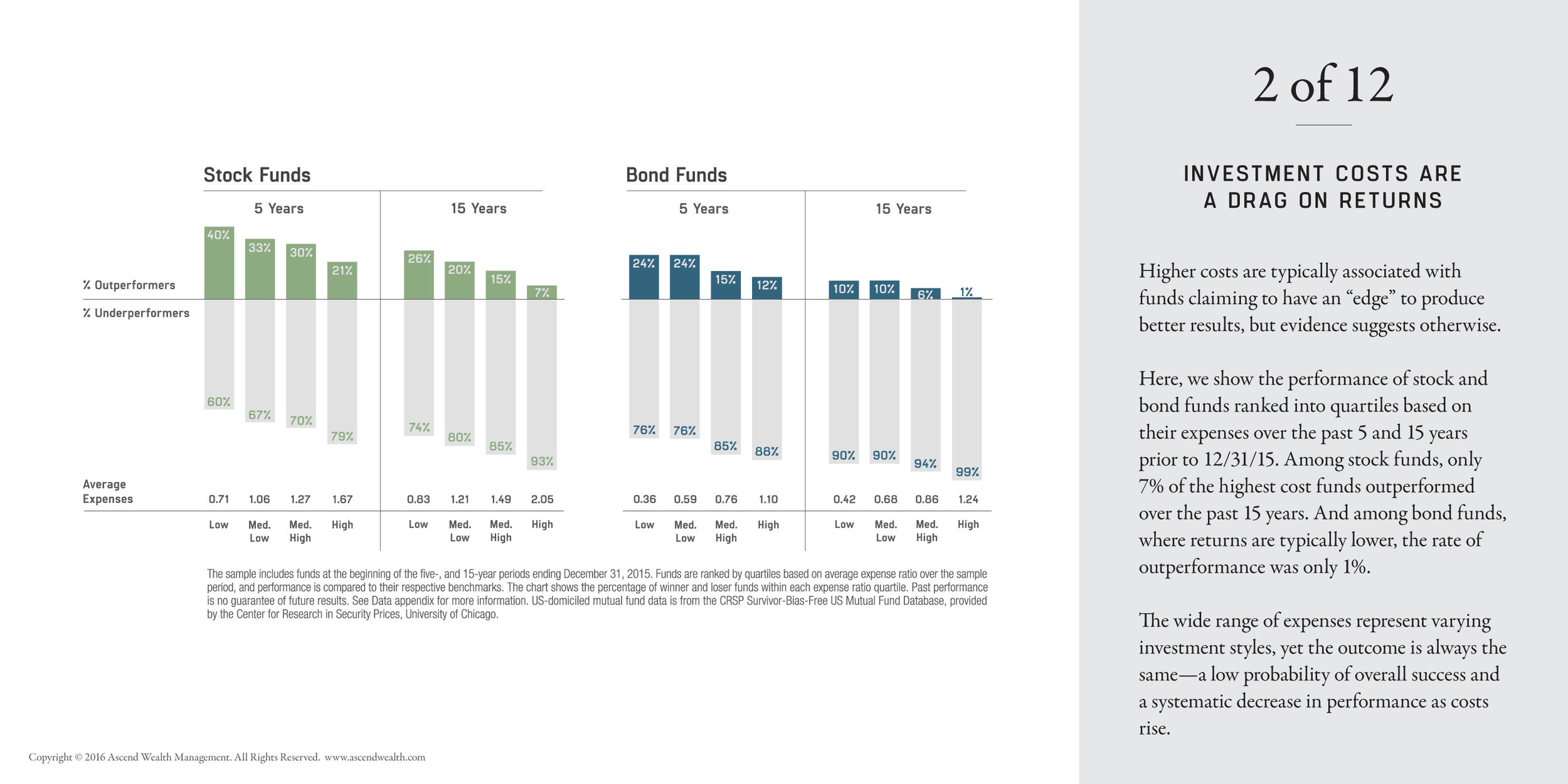

Investment Costs Are a Drag on Returns

Higher costs are typically associated with funds claiming to have an “edge” to produce better results, but evidence suggests otherwise.

Here, we show the performance of stock and bond funds ranked into quartiles based on their expenses over the past 5 and 15 years prior to 12/31/15. Among stock funds, only 7% of the highest cost funds outperformed over the past 15 years. And among bond funds, where returns are typically lower, the rate of outperformance was only 1%.

The wide range of expenses represent varying investment styles, yet the outcome is always the same—a low probability of overall success and a systematic decrease in performance as costs rise.

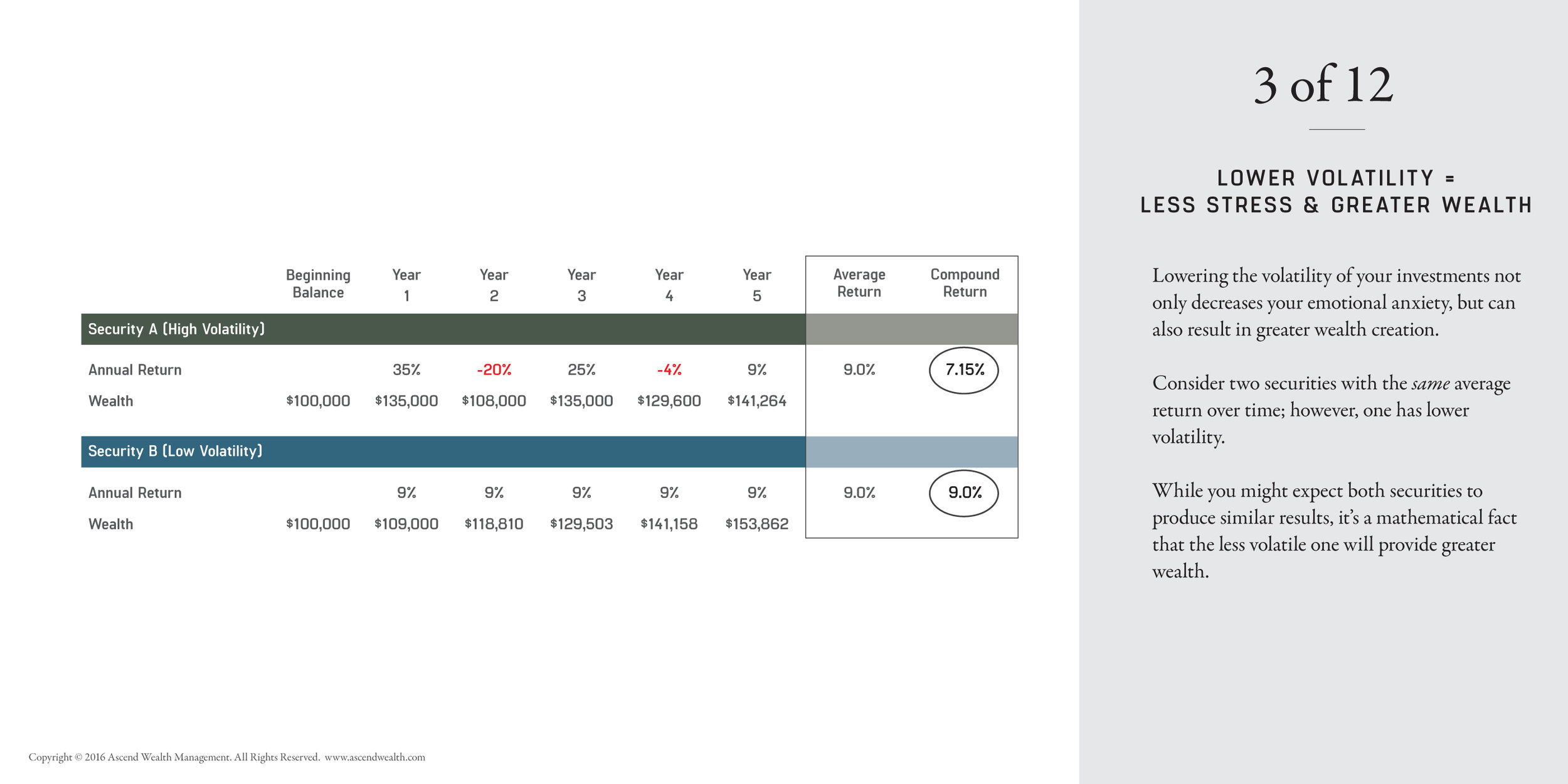

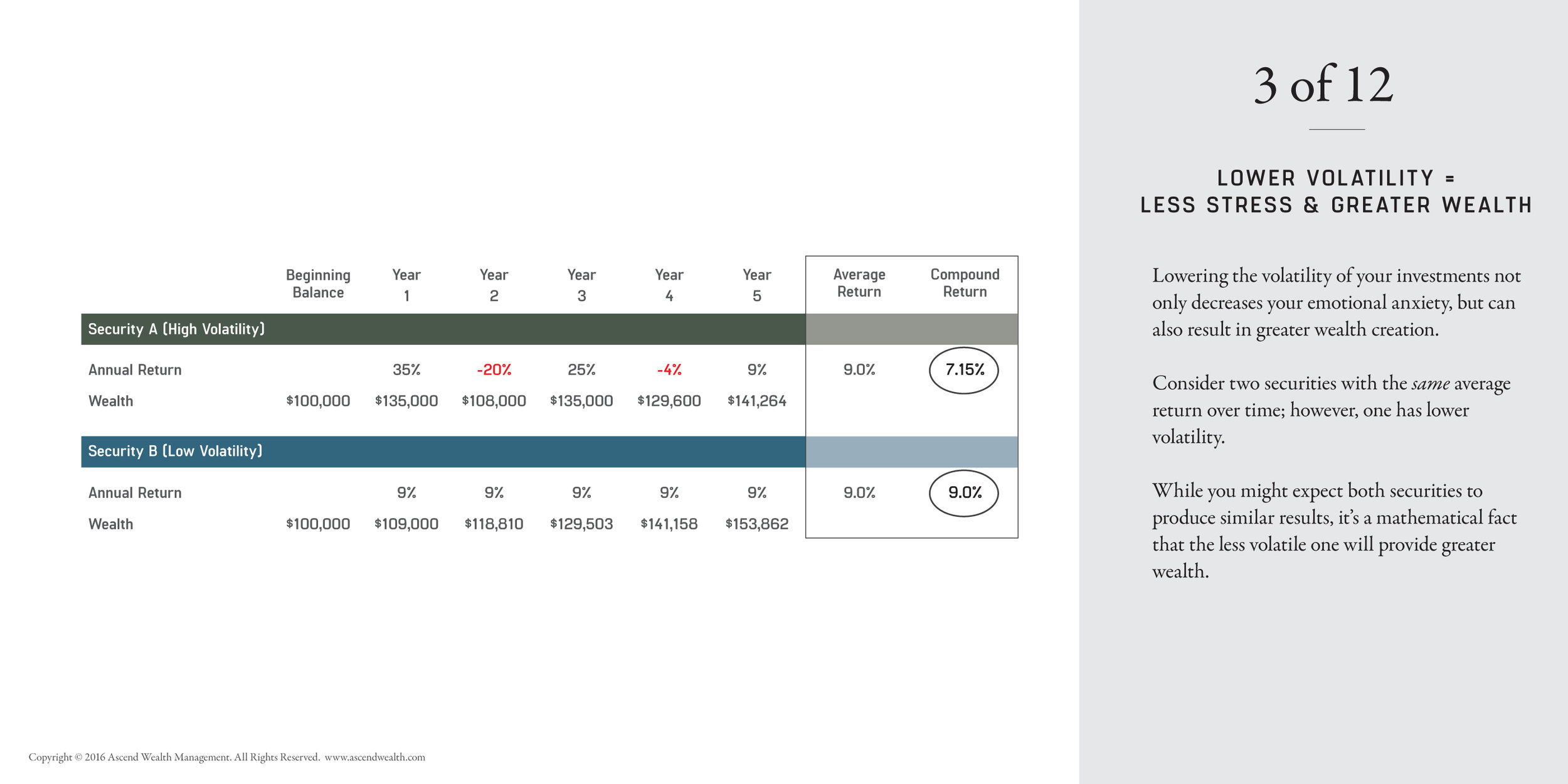

Lower Volatility = Less Stress and Greater Wealth

Lowering the volatility of your investments not only decreases your emotional anxiety, but can also result in greater wealth creation.

Consider two securities with the same average return over time; however, one has lower volatility.

While you might expect both securities to produce similar results, it’s a mathematical fact that the less volatile one will provide greater wealth.

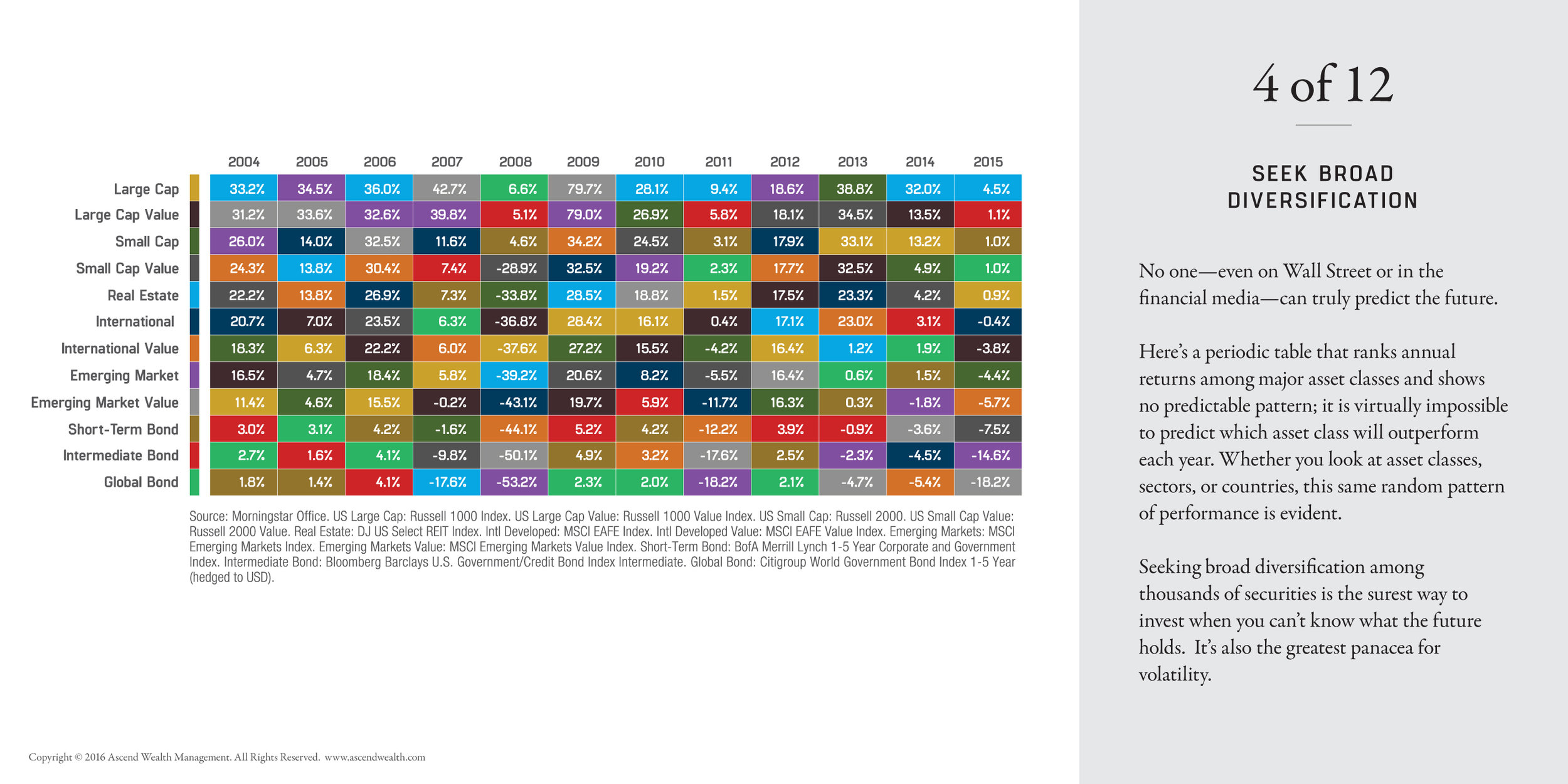

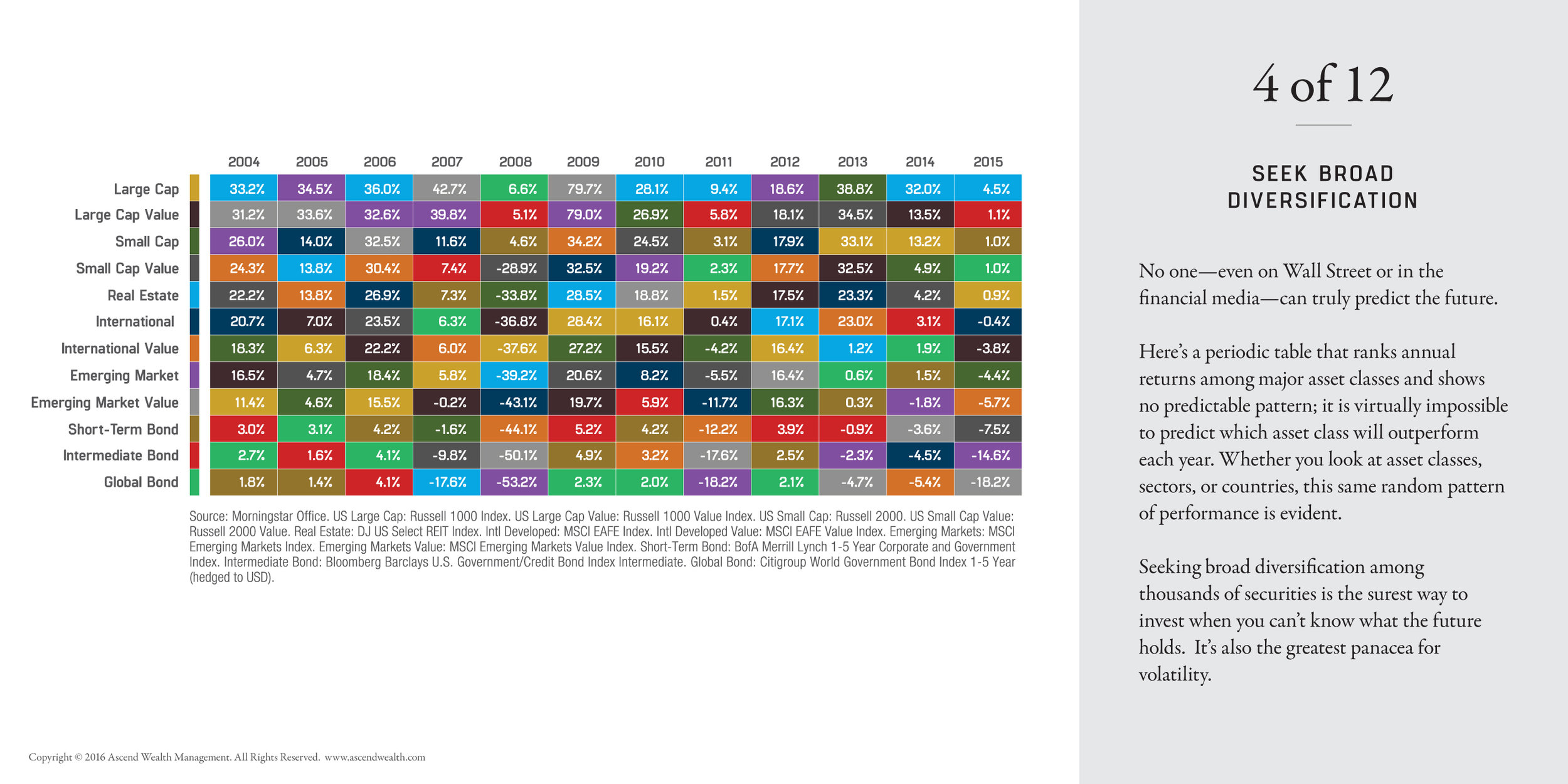

Seek Broad Diversification

No one—even on Wall Street or in the financial media—can truly predict the future.

Here’s a periodic table that ranks annual returns among major asset classes and shows no predictable pattern; it is virtually impossible to predict which asset class will outperform each year. Whether you look at asset classes, sectors, or countries, this same random pattern of performance is evident.

Seeking broad diversification among thousands of securities is the surest way to invest when you can’t know what the future holds. It’s also the greatest panacea for volatility.

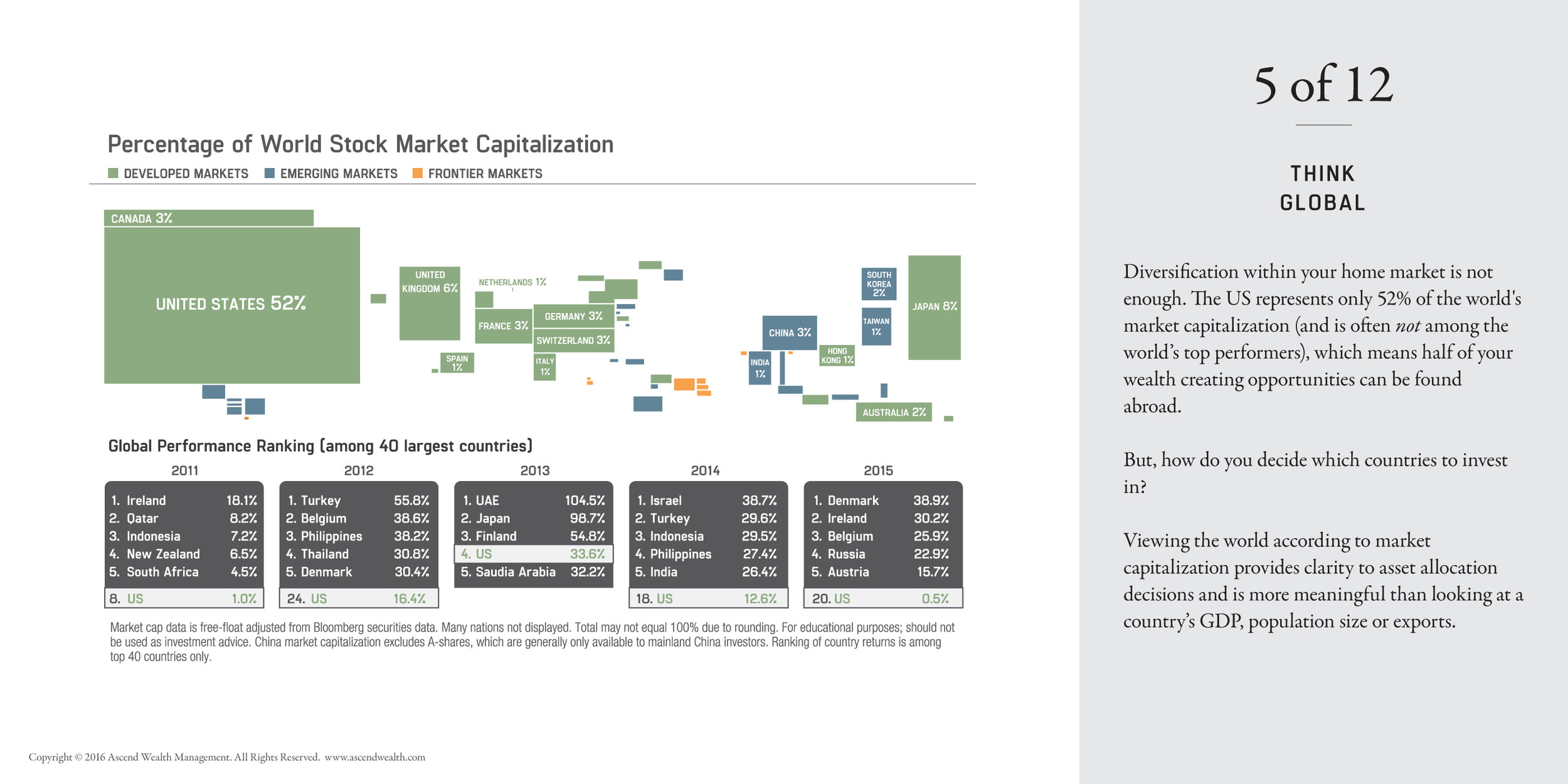

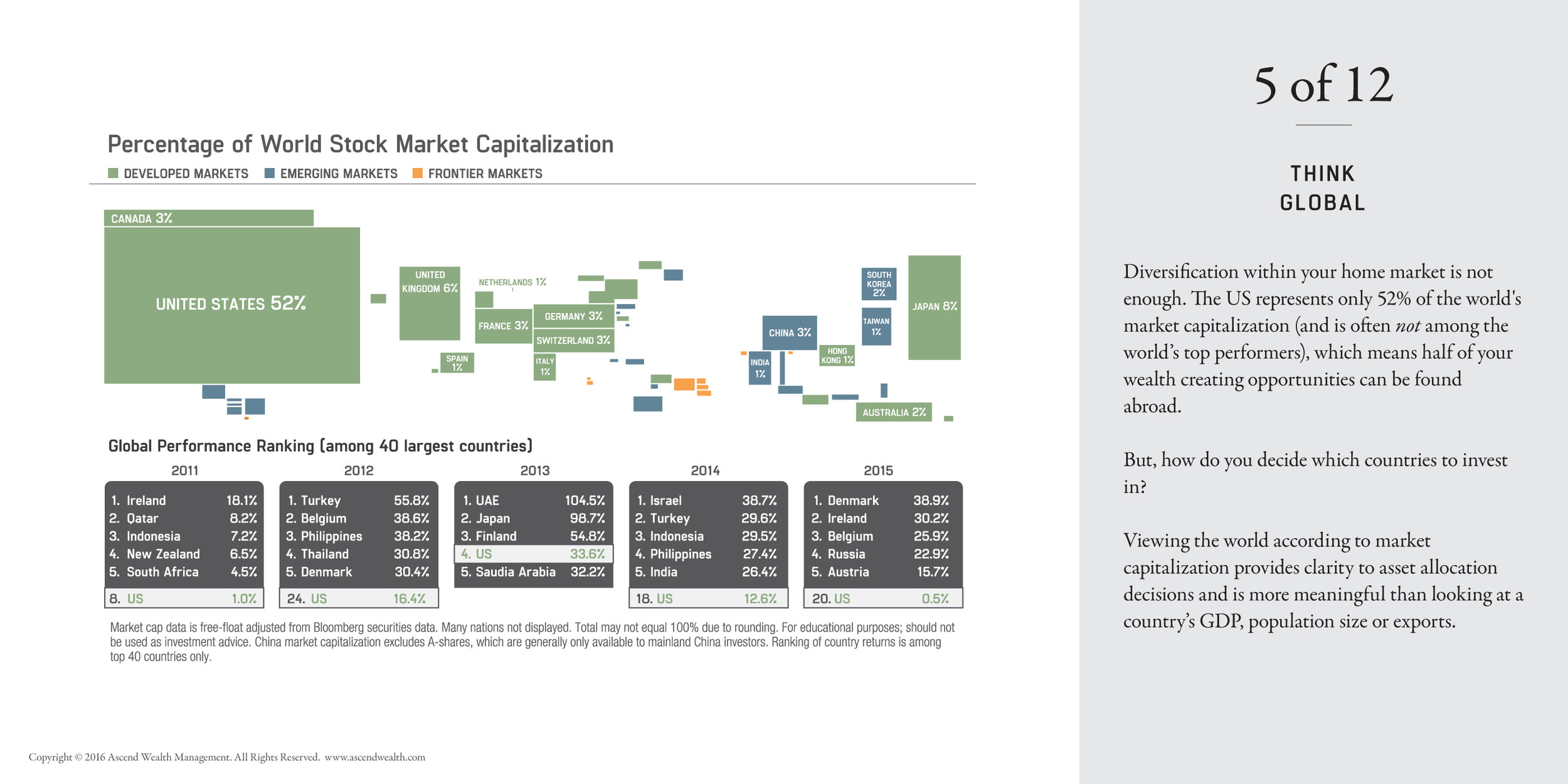

Think Global

Diversification within your home market is not enough. The US represents only 52% of the world's market capitalization (and is often not among the world’s top performers), which means half of your wealth creating opportunities can be found abroad.

But, how do you decide which countries to invest in?

Viewing the world according to market capitalization provides clarity to asset allocation decisions and is more meaningful than looking at a country’s GDP, population size or exports.

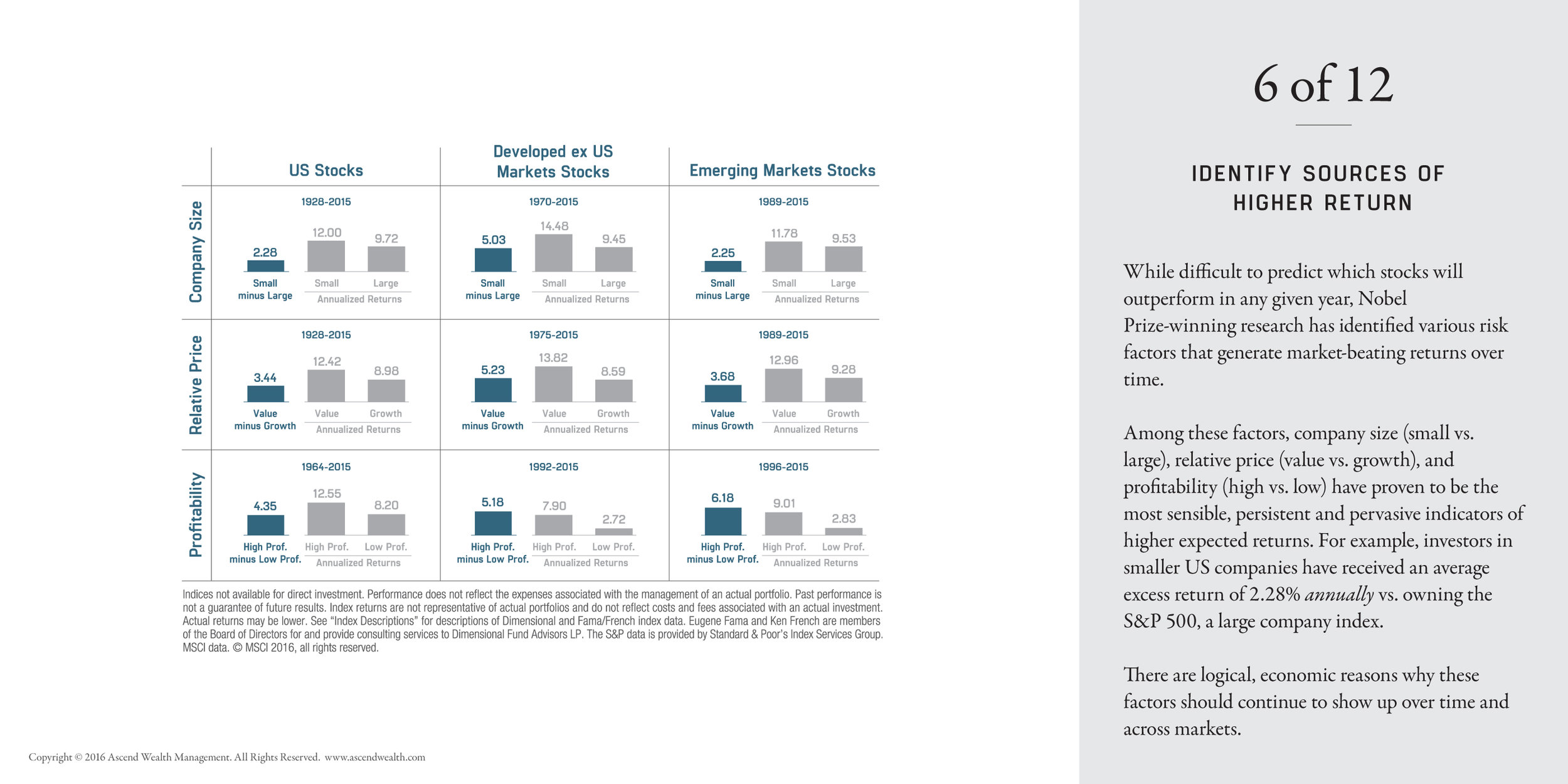

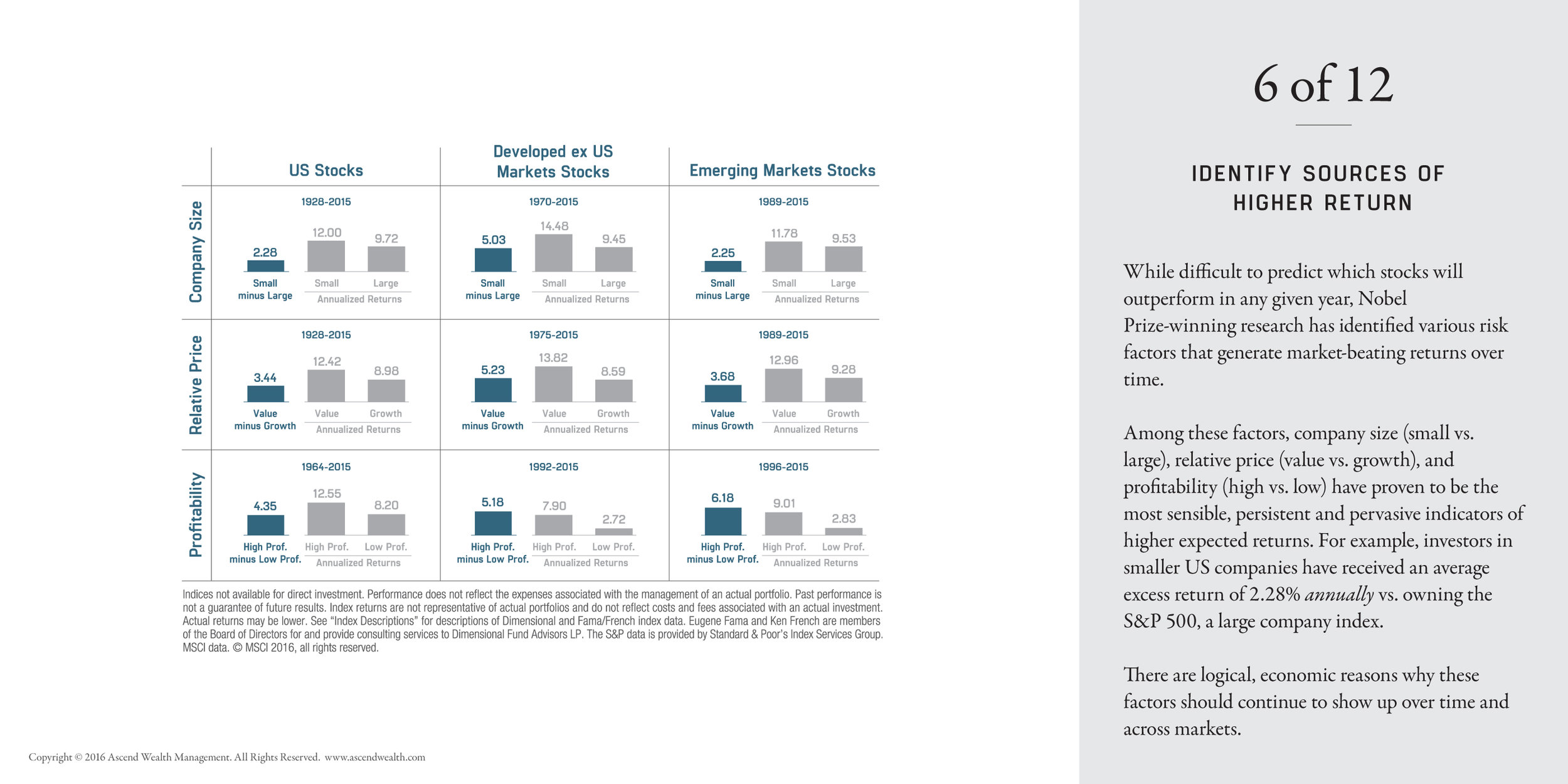

Identify Sources of Higher Return

While difficult to predict which stocks will outperform in any given year, Nobel Prize-winning research has identified various risk factors that generate market-beating returns over time.

Among these factors, company size (small vs. large), relative price (value vs. growth), and profitability (high vs. low) have proven to be the most sensible, persistent and pervasive indicators of higher expected returns. For example, investors in smaller US companies have received an average excess return of 2.28% annually vs. owning the S&P 500, a large company index.

There are logical, economic reasons why these factors should continue to show up over time and across markets.

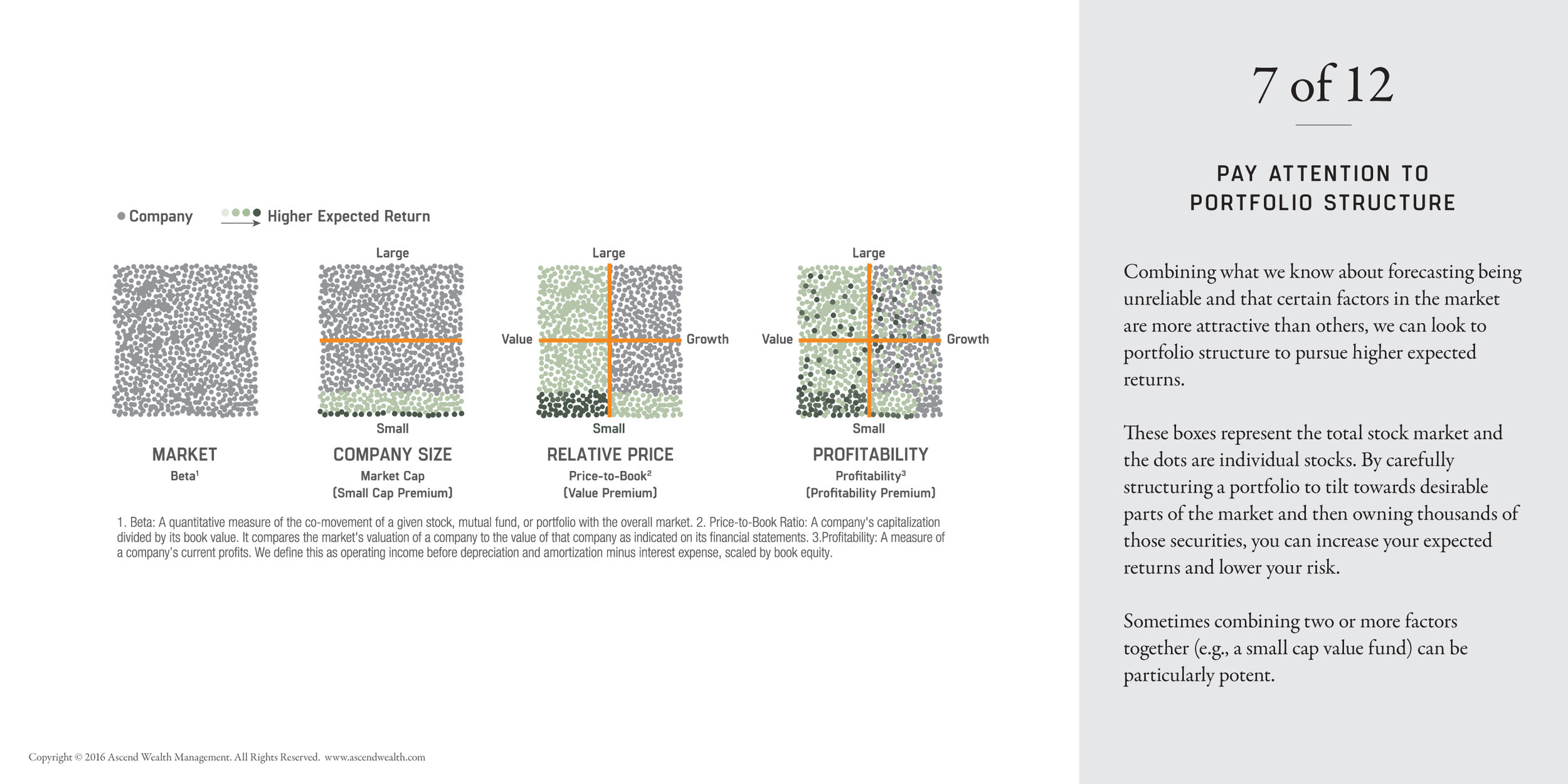

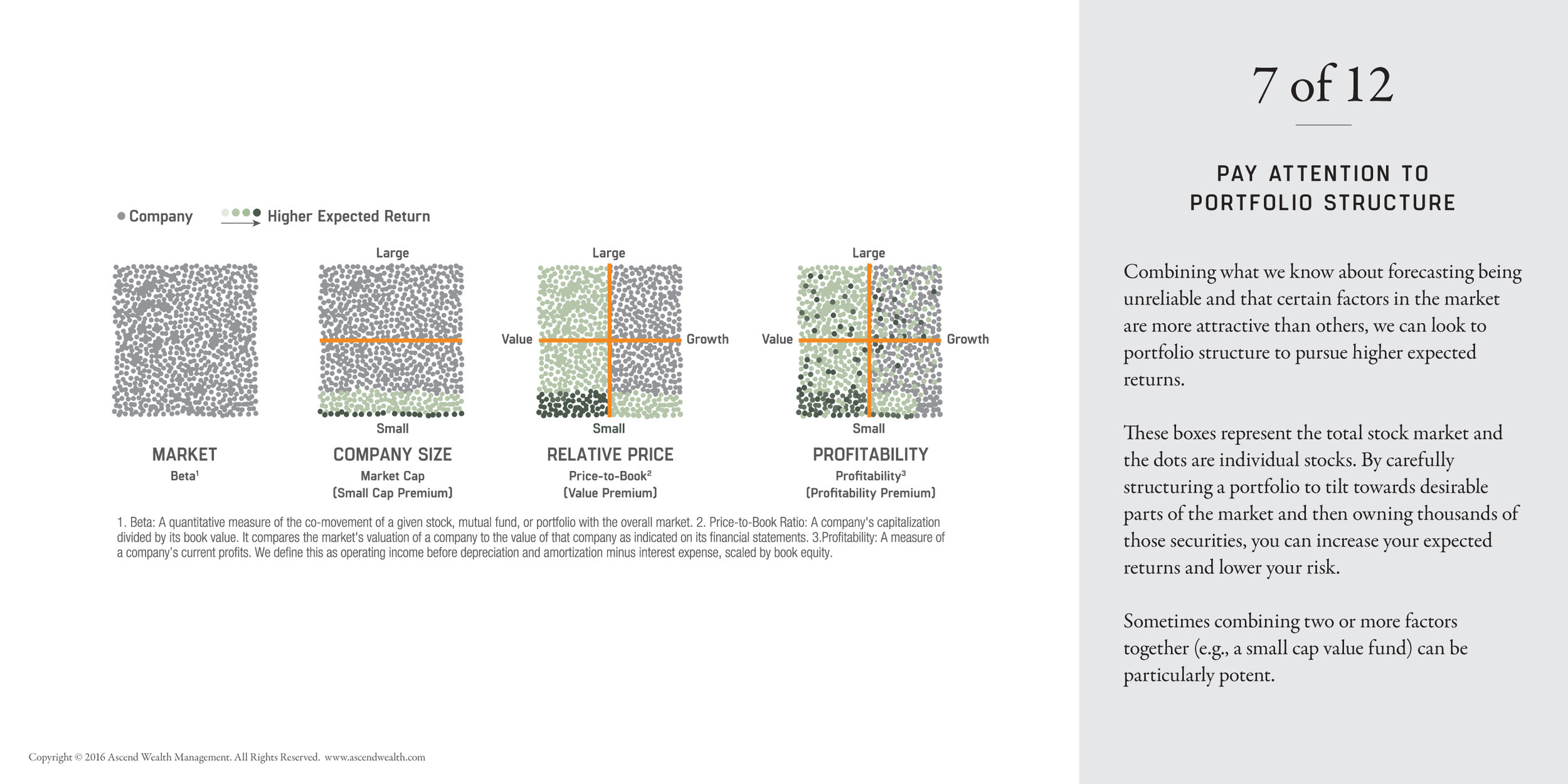

Pay Attention to Portfolio Structure

Combining what we know about forecasting being unreliable and that certain factors in the market are more attractive than others, we can look to portfolio structure to pursue higher expected returns.

These boxes represent the total stock market and the dots are individual stocks. By carefully structuring a portfolio to tilt towards desirable parts of the market and then owning thousands of those securities, you can increase your expected returns and lower your risk.

Sometimes combining two or more factors together (e.g., a small cap value fund) can be particularly potent.

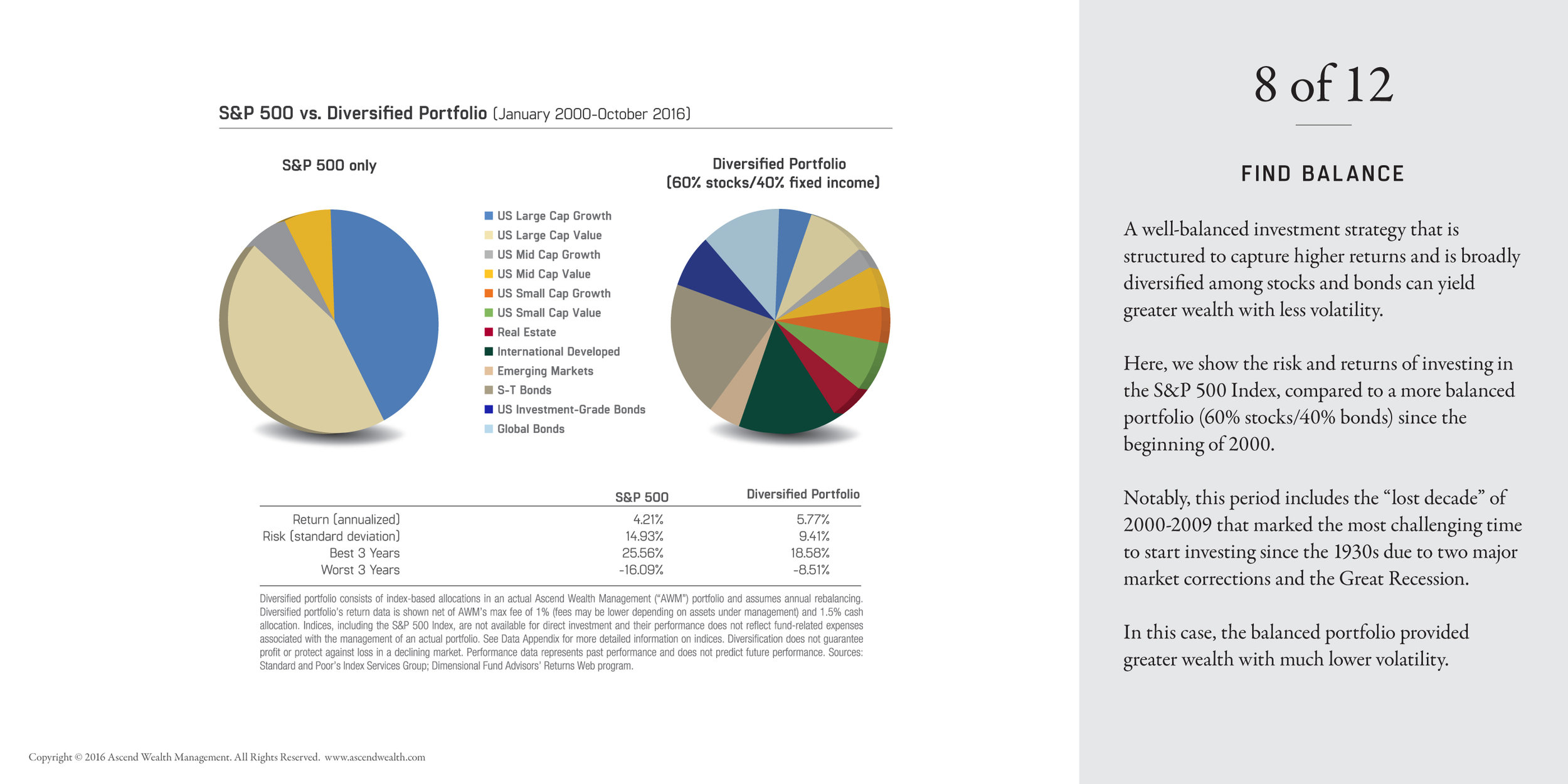

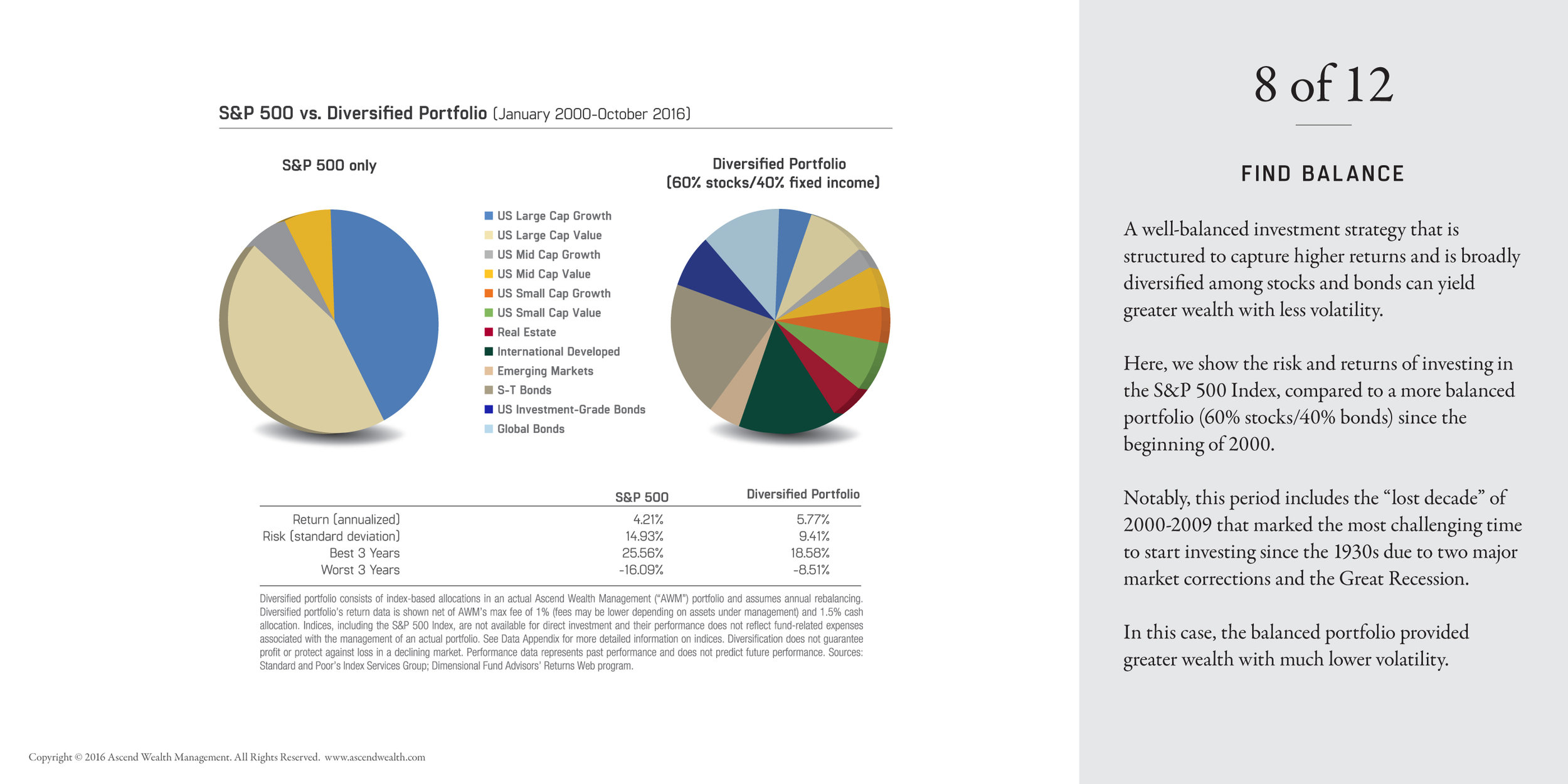

Find Balance

A well-balanced investment strategy that is structured to capture higher returns and is broadly diversified among stocks and bonds can yield greater wealth with less volatility.

Here, we show the risk and returns of investing in the S&P 500 Index, compared to a more balanced portfolio (60% stocks/40% bonds) since the beginning of 2000. Notably, this period includes the “lost decade” of 2000-2009 that marked the most challenging time to start investing since the 1930s due to two major market corrections and the Great Recession.

In this case, the balanced portfolio provided greater wealth with much lower volatility.

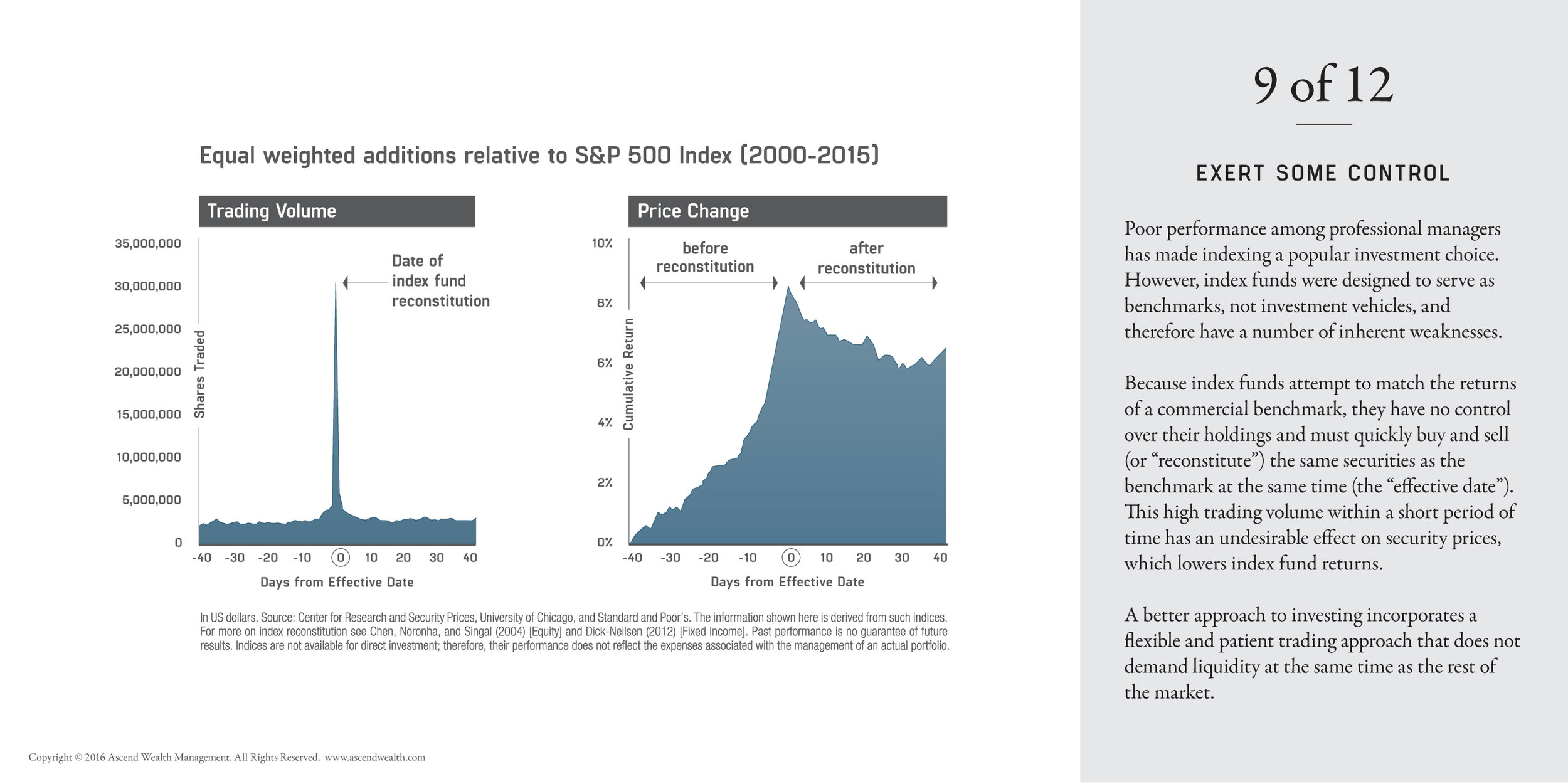

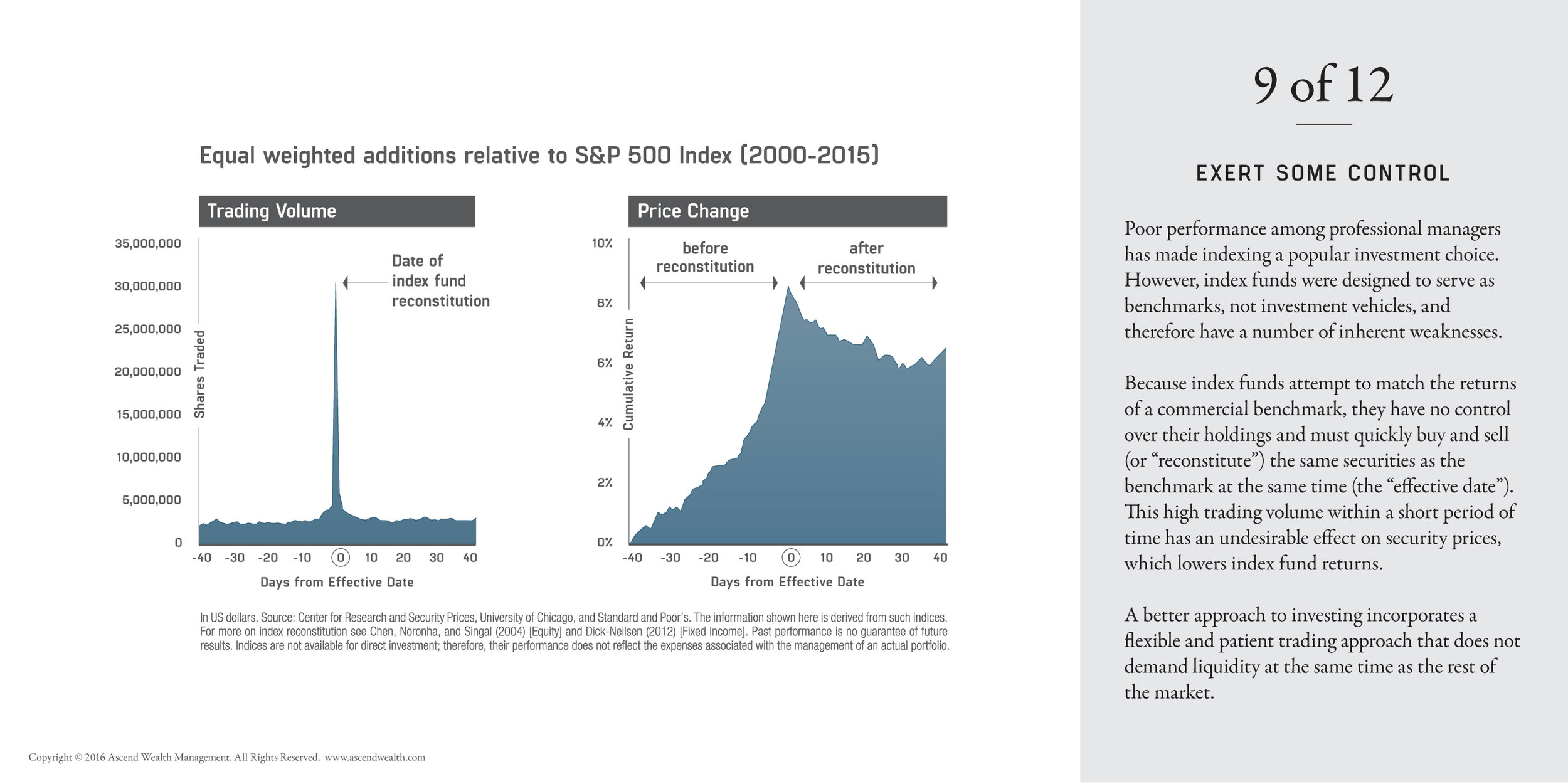

Exert Some Control

Poor performance among professional managers has made indexing a popular investment choice. However, index funds were designed to serve as benchmarks, not investment vehicles, and therefore have a number of inherent weaknesses.

Because index funds attempt to match the returns of a commercial benchmark, they have no control over their holdings and must quickly buy and sell (or “reconstitute”) the same securities as the benchmark at the same time (the “effective date”). This high trading volume within a short period of time has an undesirable effect on security prices, which lowers index fund returns.

A better approach to investing incorporates a flexible and patient trading approach that does not demand liquidity at the same time as the rest of the market.

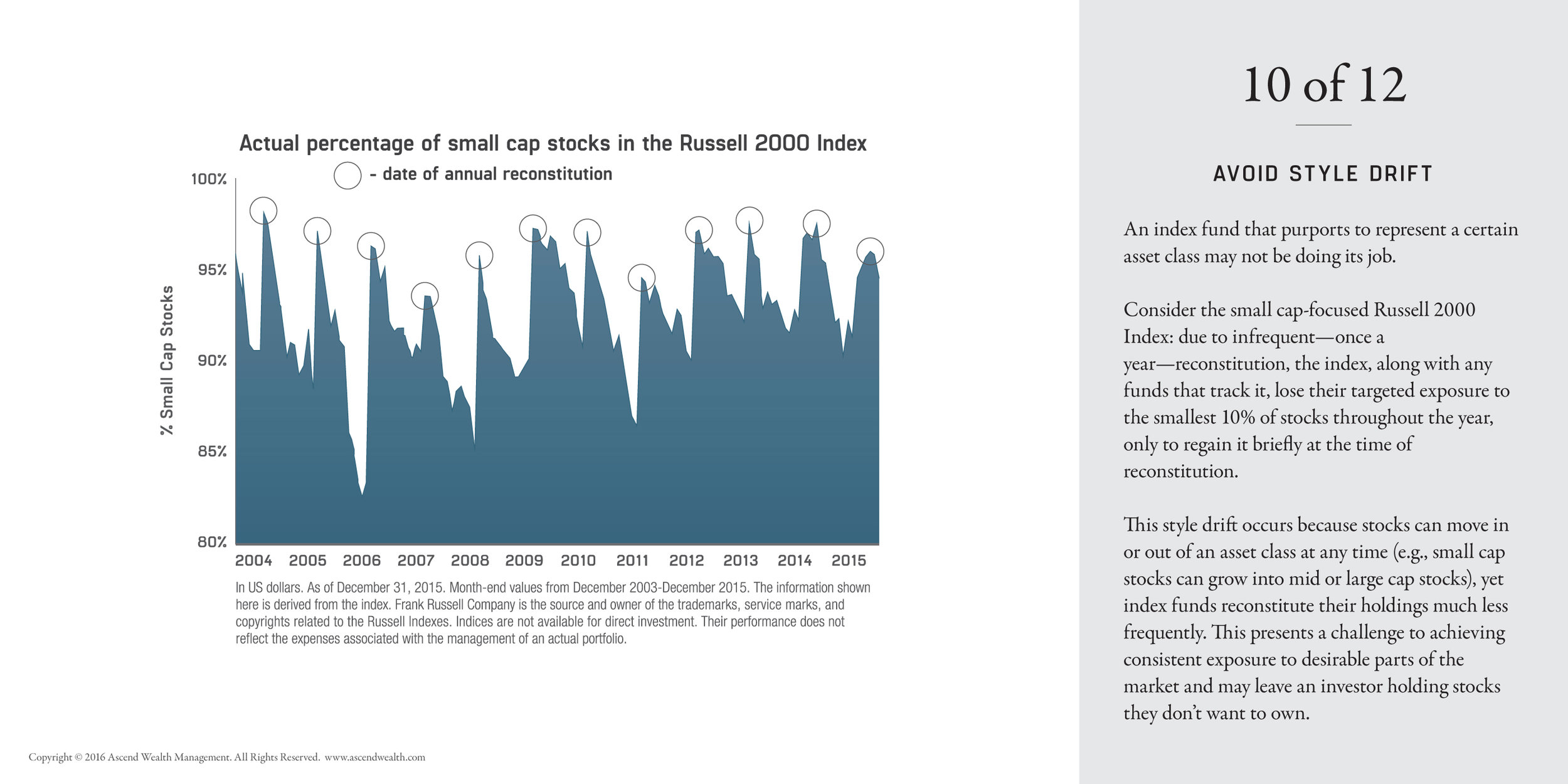

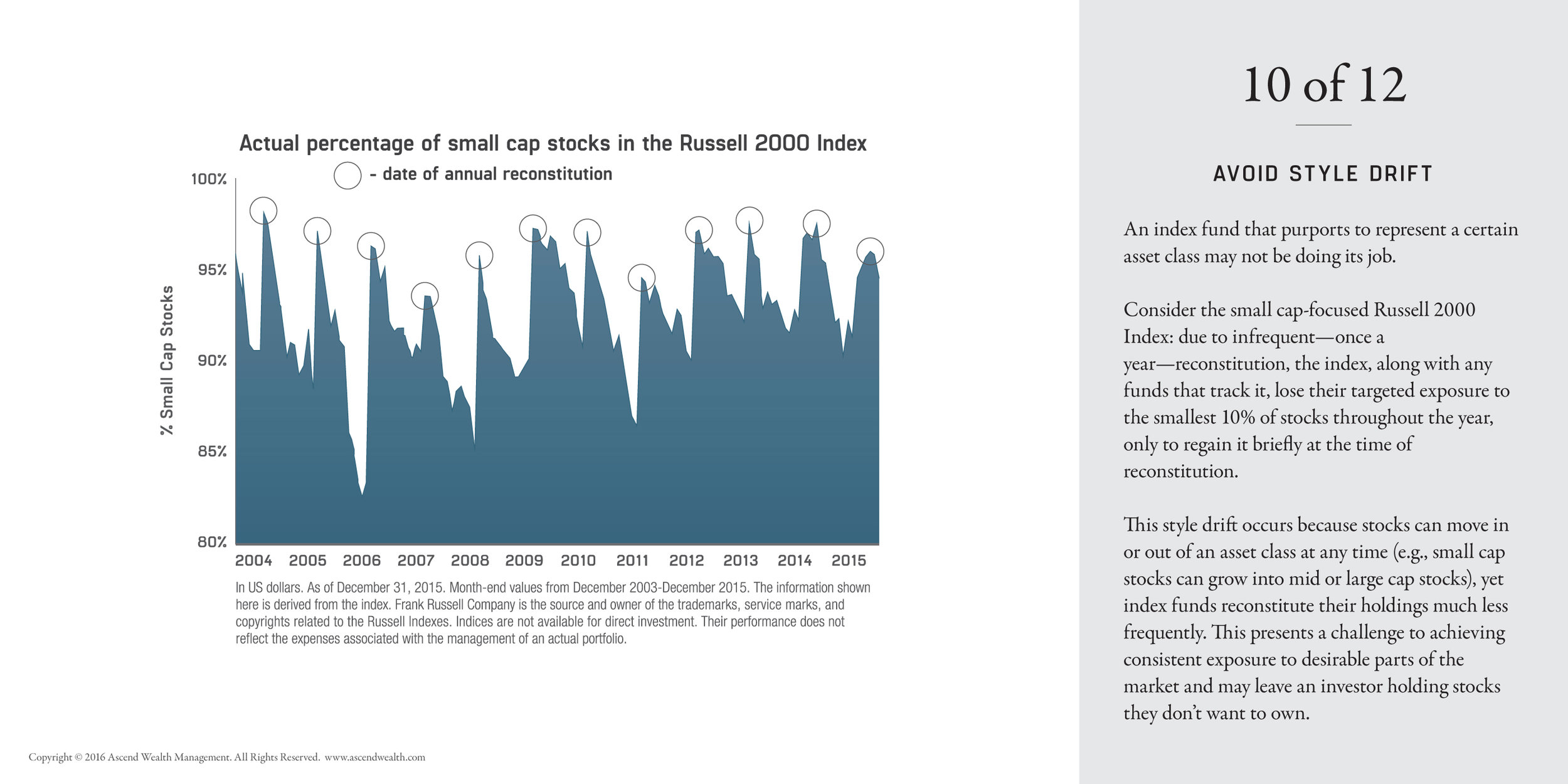

Avoid Style Drift

An index fund that purports to represent a certain asset class may not be doing its job.

Consider the small cap-focused Russell 2000 Index: due to infrequent—once a year—reconstitution, the index, along with any funds that track it, lose their targeted exposure to the smallest 10% of stocks throughout the year, only to regain it briefly at the time of reconstitution.

This style drift occurs because stocks can move in or out of an asset class at any time (e.g., small cap stocks can grow into mid or large cap stocks), yet index funds reconstitute their holdings much less frequently. This presents a challenge to achieving consistent exposure to desirable parts of the market and may leave an investor holding stocks they don’t want to own.

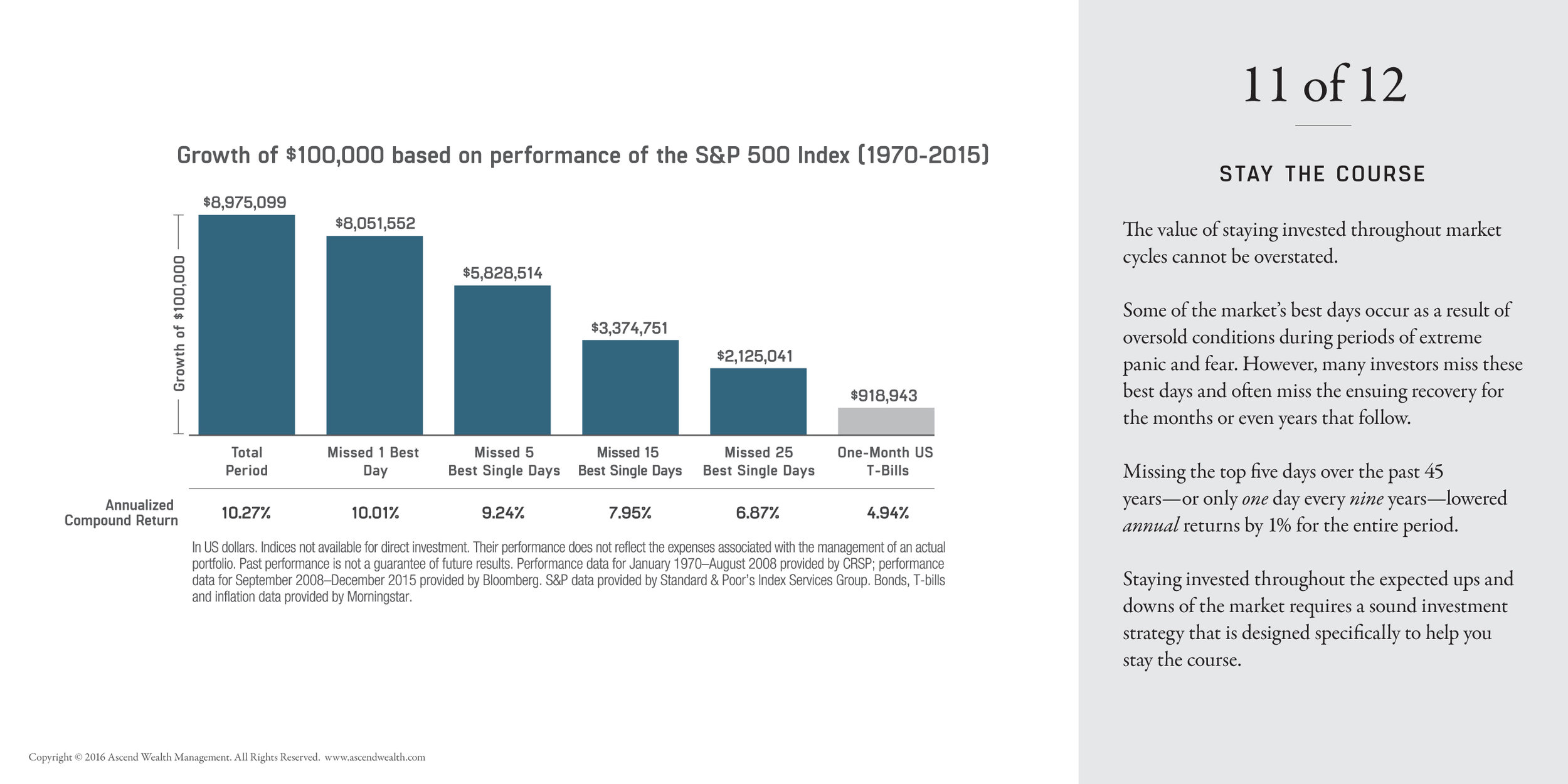

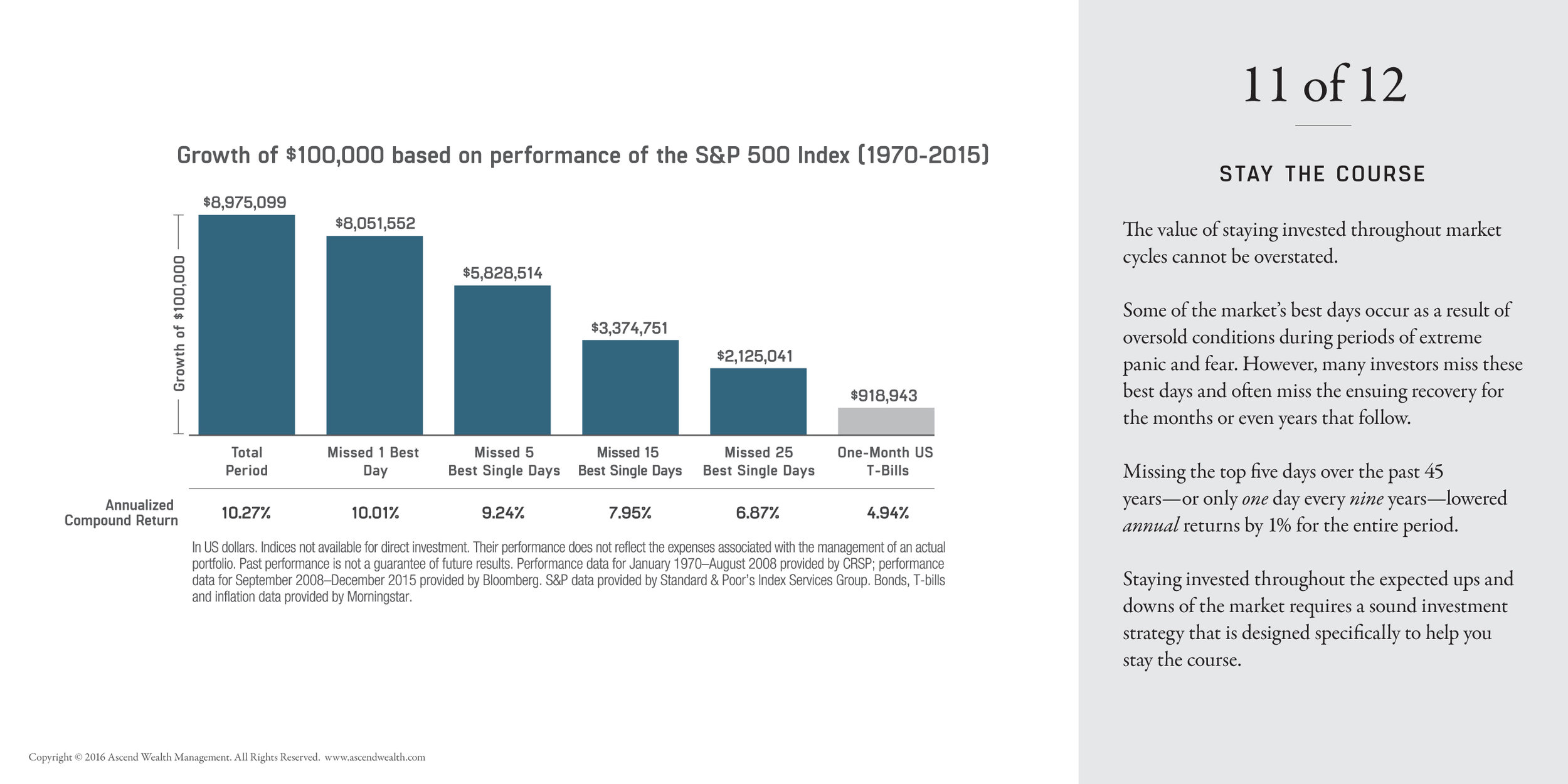

Stay the Course

The value of staying invested throughout market cycles cannot be overstated.

Some of the market’s best days occur as a result of oversold conditions during periods of extreme panic and fear. However, many investors miss these best days and often miss the ensuing recovery for the months or even years that follow.

Missing the top five days over the past 45 years—or only one day every nine years—lowered annual returns by 1% for the entire period.

Staying invested throughout the expected ups and downs of the market requires a sound investment strategy that is designed specifically to help you stay the course.

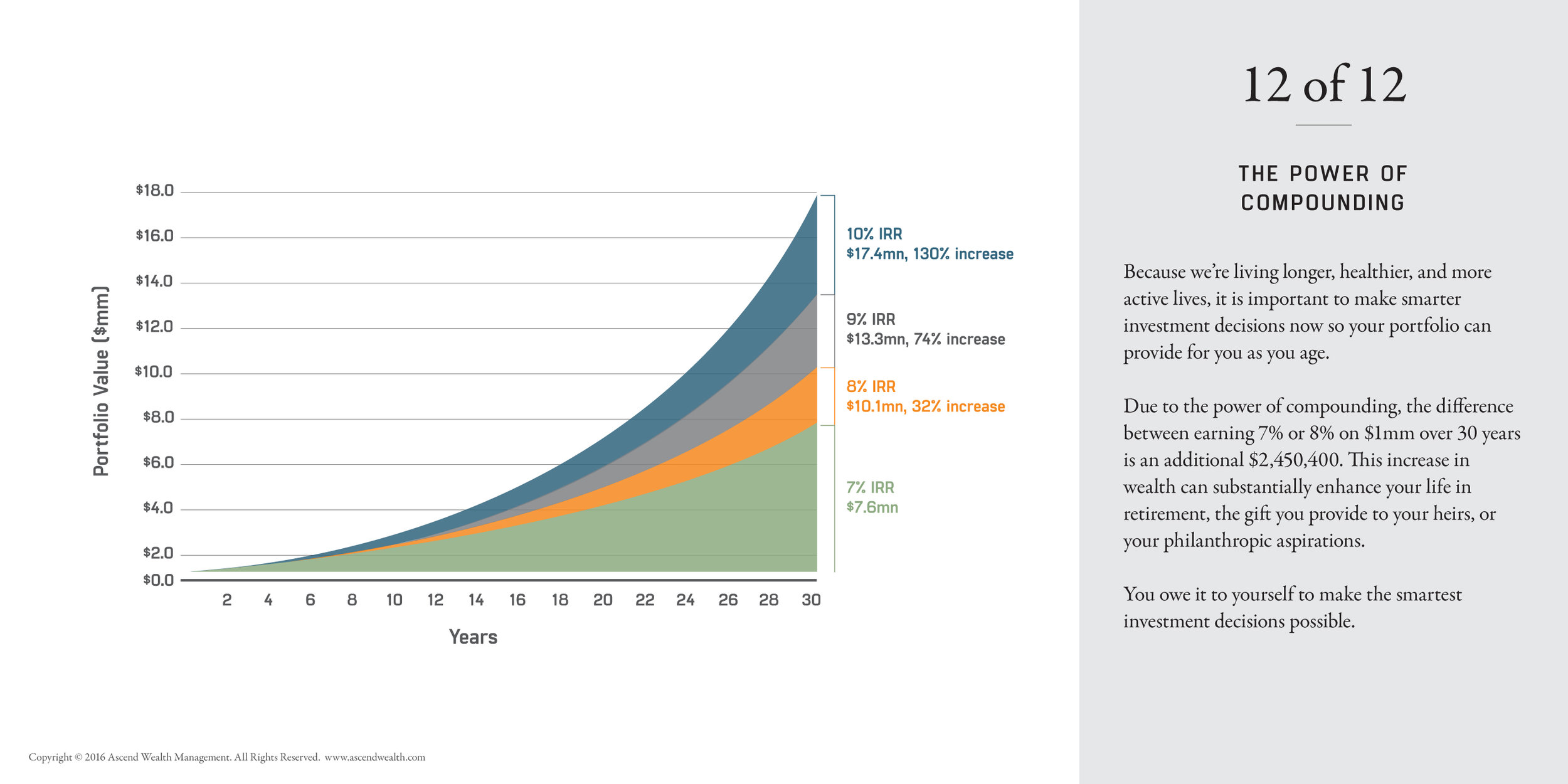

The Power of Compounding

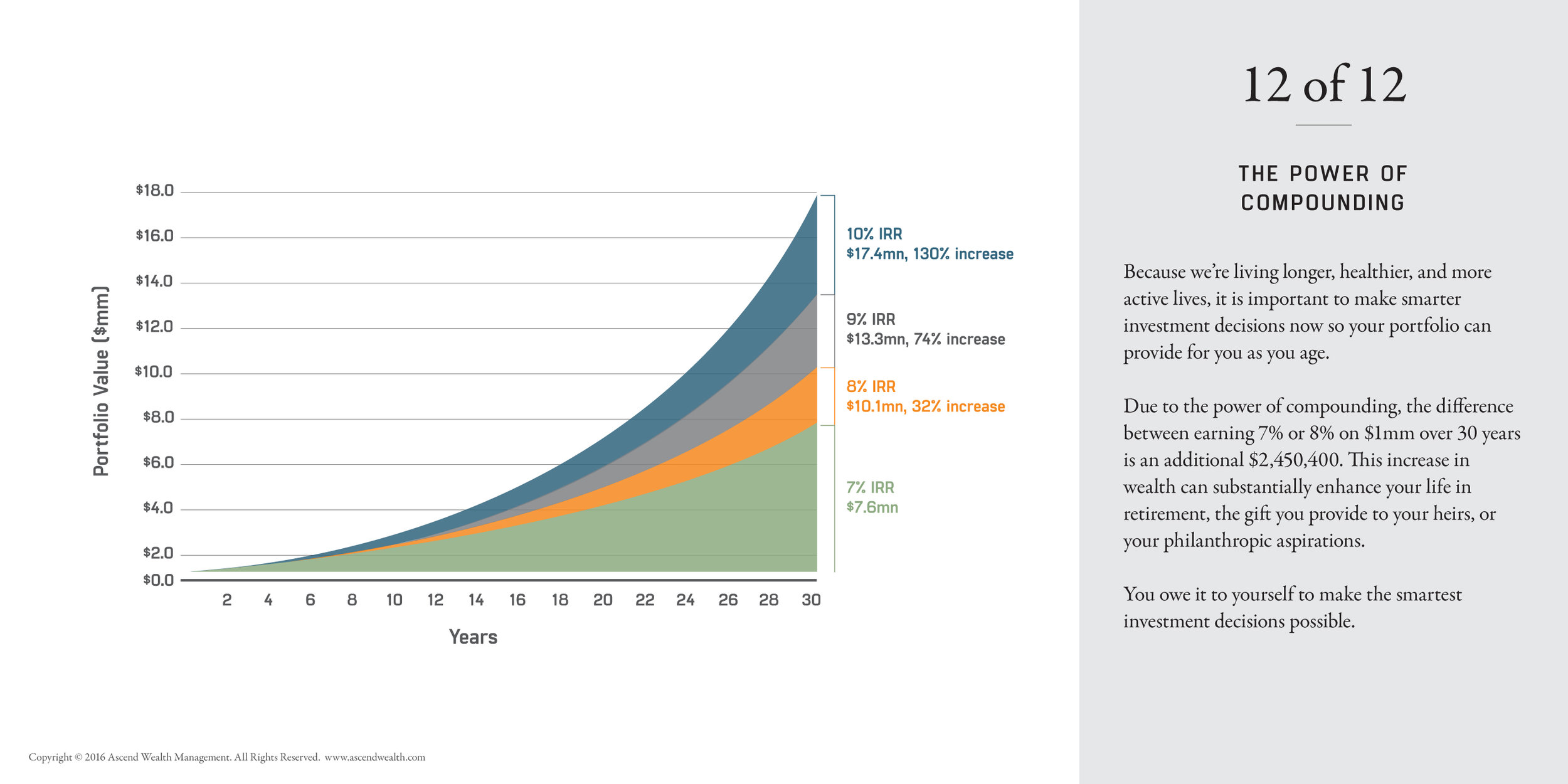

Because we’re living longer, healthier, and more active lives, it is important to make smarter investment decisions now so your portfolio can provide for you as you age.

Due to the power of compounding, the difference between earning 7% or 8% on $1mm over 30 years is an additional $2,450,400. This increase in wealth can substantially enhance your life in retirement, the gift you provide to your heirs, or your philanthropic aspirations.

You owe it to yourself to make the smartest investment decisions possible.